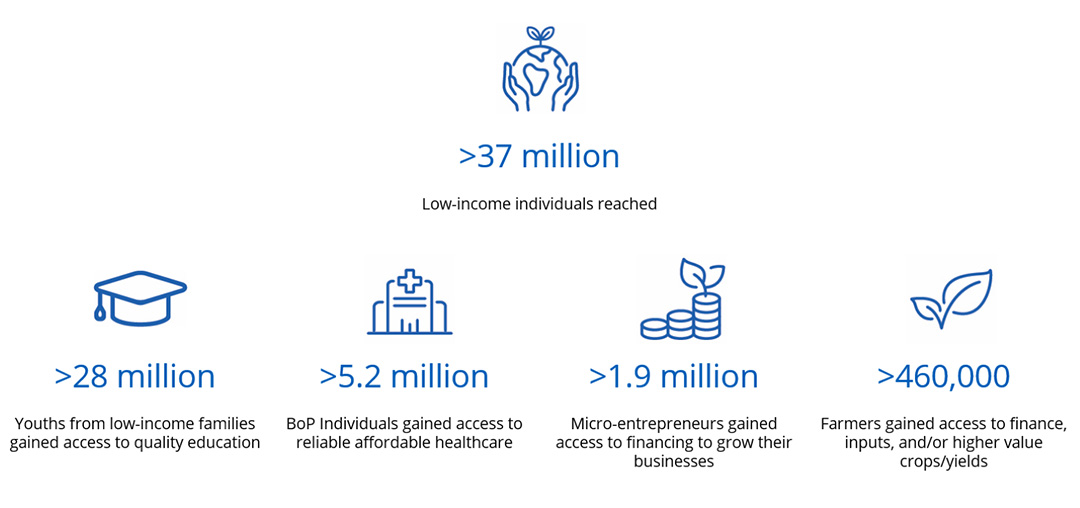

The Fund will focus on modernisation of agriculture and application of technology to improve crop yields and efficiency, including opportunities in agro-processing, food production, primary production, agricultural infrastructure, agricultural inputs, aquaculture and the cultivation of niche and high-value products.

The Fund will look at companies that provide sustainable solutions that cater to the healthcare needs of the BoP such as service providers, distributors and retailers of healthcare solutions, companies that provide pooled healthcare products, companies that provide medical education and companies that uses technology to facilitate provision of healthcare services, amongst others.

The Fund believes that the BoP’s demand for education will continue to rise steadily thereby generating investment opportunities in areas such as primary, secondary and tertiary education, as well as adult and vocational education.